Return to the Mecca of Capitalism?

Submitted by Foundation Private Wealth Management on October 9th, 2012Based on a number of conversations I’ve had recently, there appears to be a disconnect between the prevailing thoughts on recent market performance and the reality of what has been happening. If I told you that, as of October 3rd, US Markets (using the S&P 500 as an example) have outperformed the TSX in Canada by 12.38% year-to-date, would you believe me?

If you trust me, I’m sure you would. However, most people do not know the reality of this and, given the chart below, it’s easy to understand why. With the common idea being that Canada is a much stronger market to invest than our neighbours to the South, I’m going to go against the grain and give you three reasons why I see a renaissance in US equities on the horizon.

Above is a chart from Yahoo Finance that displays the return of the S&P over the last 12 years. A couple things jump out at me as I look at this:

- What a roller coaster! It has not been an easy time to be invested, in particular, in U.S. equity markets.

- Down in the bottom right hand corner we can see that, despite the volatility, investors ended up losing almost 13% over this period by investing in the S&P 500 Index.

With a picture like this, it is hard to see how I believe that the US is poised for revitalization, but investment returns are, fortunately, not based on what has happened in the past but rather what expectations are for the future. With that said, I feel there are three fundamental forces that are going reinvigorate, reshape and transform the US economy, making it a very attractive place for investment going forward.

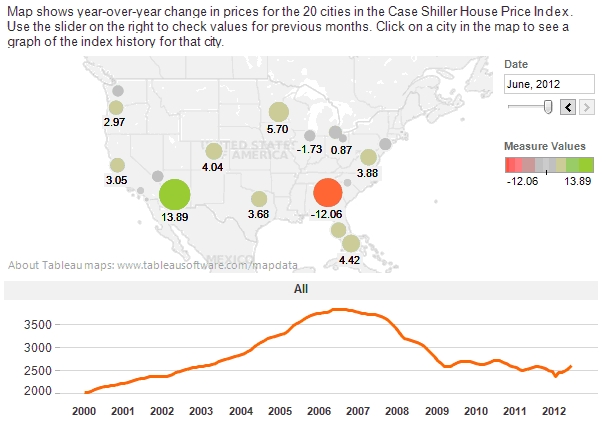

1. The Beginning of the End of the Housing Crisis

The above chart, generated using Case-Schiller US Housing Price data from Tableau Public (I would highly recommend this charting software for those that are interested), provides a visual of one of the most fundamental trends that is now occurring in the US. As we all know, in late 2007 through 2008, the housing market collapsed causing the global economy to slip into what has now been called the “Great Recession”. This can be seen in the chart above where the orange line drops significantly mid-way through 2007 until early 2009. Looking forward, though, I feel that the most important thing we can take from this chart is where the orange line has started to trend upwards from the bottom, likely signaling the beginning of the end of the decline in US housing prices.

The significance of this event cannot be overstated; since the Great Recession started here, any growth going forward will require an improvement in this area. According to Lawrence Yun, chief economist of the National Association of Realtors, in an Article published by Reuters on August 29th 2012, “All regions saw monthly increases in home-buying activity except for the West, which is now experiencing an acute inventory shortage”. This is momentous! Since the primary residence is the main asset for most Americans, they will not feel confident if their house continues to depreciate and their net worth declines accordingly. Resurgence in US housing market will ultimately lead to increased consumer confidence and higher consumer spending.

2. Reshoring

By now, we have all become familiar with the term “off-shoring”, where jobs that were domesticated in the developed world have been systematically shifted to the emerging economies in order to take advantage of their cheap labour. This created a drag on the developed world as their economies have lost numerous jobs, primarily in the manufacturing sector, causing a cascading effect with ancillary industries and sectors. Off-shoring hasn’t been without benefits, however, as the price of goods in the developed world has remained relatively low as a result of cheaper labour overseas.

As time has gone, this benefit has been marginalized as the labour costs in the developing world have risen without a corresponding rise in productivity. Furthermore, with oil prices on the rise, the cost of shipping has steadily increased as well. This has lead to a new trend, which has been cleverly coined as “Reshoring”, where companies bring back their labour state side as it has become more profitable to do so.

In a July 18th Wall Street Journal Article, entitled “Some Firms Opt to Bring Manufacturing Back to U.S.”, cited a Boston Consulting Group study from February 2012 that found that, of 106 companies with annual sales of $1 billion or more, 37% were planning or considering bringing jobs back to the US. The primary reasons these companies were reshoring included, time to market, reduced transportation and warehousing costs, improved quality and better protection of intellectual property.

As part of my research for this blog, I uncovered a website called the Reshoring Initiative. It has a tremendous amount of material relating to reshoring, including a number of case studies that highlight the rationale for reshoring. They also have a tool that allows you to calculate the Total Cost of Ownership which allows American companies to determine what it would cost to produce their goods onshore as opposed to offshore.

3. Energy Independence

This alone should transform the US economy and change the geopolitical landscape as we know it! If you followed the Republican primaries this year, I am sure that you heard many of the candidates pledging to bring energy independence to the US by around 2020 (especially Mitt Romney, who has campaigned heavily on this). This all sounds pie in the sky, as many other potential candidates in the past have pledged to do this and, whether elected or not, it has never been achieved. To use an Obama-ism (I feel like I have to given that we are caught up in election fever)… “Yes we can”, but how?

According to a USA Today article by Tim Mullaney, updated on May 15, 2012, entitled “U.S. Energy Independence is no longer just a pipe dream”:

The U.S. Energy Information Agency says U.S. oil imports will drop by 20% by 2025. Oil giant BP projects that U.S. will get 94% of its energy domestically by 2030, up to 75% now, as oil imports fall by half. Energy billionaire T. Boone Pickens, a major investor in oil and natural gas companies, said the U.S. can at least end oil imports from Organization of Petroleum Exporting Countries, about half its total, through new drilling and by shifting diesel-swilling trucks to natural gas. Any other oil needs should be from politically stable allies such as Canada, Pickens said.

This will have a resoundingly positive effect on the U.S. economy in the following ways:

- To extract the resources from these deposits, direct labour will be needed and the trickledown effect will create all sorts of spinoff jobs. This is not unlike the phenomenon we have seen in places like Fort McMurray, Alberta. To highlight this, here’s a the parallel with a similar situation in Williston, North Dakota.

- In a research report produce in May 2011, by Capital Partners LLP out of the UK, they discuss some of the incomes that are being earned by two types of people working the oil fields in Williston:

- Direct Labour – Fracking teams are being flown in by private charter from Texas, where their skills have been honed, for minimum 5-week shifts and are earning roughly $12,000 in that period.

- Indirect Labour - Applebees Williston (fine dining at its best) waitresses can earn up to $200 in tips a night and over $70,000 per year. And, not to be outdone in chasing after the scarce labour supply, McDonalds is offering $300 signing bonuses, while paying 3 times minimum wage.

- In a research report produce in May 2011, by Capital Partners LLP out of the UK, they discuss some of the incomes that are being earned by two types of people working the oil fields in Williston:

All-in-all Citi Group, in the “U.S. Energy Independence is no longer just a pipe dream” article, estimated that over the coming decade, 3.6million jobs will be created as a result of the energy renaissance in the US.

- The abundance of energy in the US economy, in this case more from natural gas than oil, will reduce the cost of manufacturing and transporting goods within the U.S. In the earlier quote, T. Boone Pickens refers to the conversion of diesel truck to natural gas, which costs a fraction of the price. This also overlaps with the reshoring trend as most developing nations do not have the infrastructure in place or the resources to convert from diesel to natural gas.

- Finally, as these supplies come online in the US and foreign supplies are replaced by domestic (and ally) supplies, there will be a profound impact on the inflows and outflows of money in the US. No longer will dollars be sent to politically unstable areas of the world, where funds are arguably being used against us at some level, but will be retained within the North American economy. According to Chris Lafakis, an energy economist at Moody’s Analytics, the potential $160 billion in funds retained in the US from not having to purchase oil from abroad would be “like the temporary payroll tax cut we now have, plus a third, and it lasts forever.”

So what does this all mean?

Firstly, it means that there is a tremendous opportunity for the US, as a nation, going forward. More importantly, to investors it means that there is a great opportunity to invest in high quality companies that trade in a familiar and politically stable region of the world. Over the next number of years, we believe that the sideways market we have seen over the last decade will not be repeated and that the U.S. will again present itself as a great market. Some early money has already been made in 2012 as we have been transitioning client portfolios to an overweight in U.S. Equities and we feel this is just the beginning…