Preparing for Tax Time

Submitted by Foundation Private Wealth Management on November 29th, 2011

As the 2011 tax year comes to an end over the next few months, we wanted to inform our clients of an opportunity to reduce your tax bill with a Flow-Through Limited Partnership (Flow-Through). Some of you might be familiar with this investment vehicle but, as I talk with clients and their accountants, I find that many are not aware of the benefits available through a Flow-Through. To give you a better sense of this investment structure, I would like to share with you the reason it exists and provides tax benefits for investors, how the mechanics work for the investment structure and why we feel that now is a great time to consider this investment.

Flow-through shares are not a new concept in the Canadian market place and have existed in various formats since 1954. The goal of introducing this structure to the Canadian tax system was to provide investors with the incentive to invest in a riskier area of the markets that requires large capital expenditures for exploration and development. In the early 1980’s, the Canadian government was then tasked with finding additional tax incentives to encourage exploration and development in the resource sector. Currently, the Canadian government allows companies to fully deduct specific exploration expenses, know as Canadian Exploration Expenses (CEE) for companies operating in oil and gas, mining base metals and renewable energy. Many resource companies then issue flow-through shares to raise capital and in turn renounce their claim to the CEE credits to the shareholder. The shareholders are then able to apply the CEE to fully deduct against any source of income.

Typically, the companies that issue flow through shares are junior resource companies which are more speculative than larger resource companies with proven reserves. With junior resource companies, in particular the ones that issue flow through shares, there is significant individual company risk. The reason for this is that the funds raised are usually earmarked for the exploration of a new property or the development of a well or mine. Given the increased risk of selecting junior resource companies it becomes very important to have a professional money manager that understands this area of the market. Generally, superior investment management teams will have members that have a background in geology and engineering so that they can adequately evaluate the merit of the projects/companies being invested in.

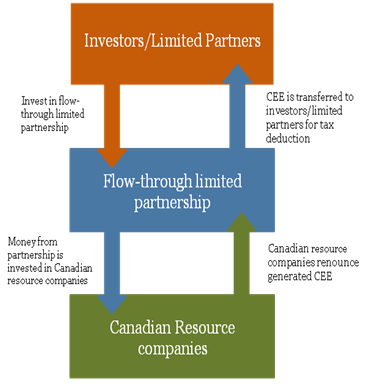

In order to access professionally managed flow-through shares, the typical vehicle used is a Flow-Through Limited Partnership. With a Flow-Through, investors are able to access a diversified portfolio of flow-through shares so that they are able to reduce the individual company risk and directly access the CEE for deduction. Figure 1 provides an illustrated view of how the funds flow from the investor to the flow-though shares when a limited partnership is used to gain access to this investment opportunity.

The tax benefits to investors with taxable income at the highest marginal rate in Ontario (this is income over $127,000) can be substantial. Furthermore, for Ontario residents only, there is an additional tax benefit by investing in a “Super Flow-Through”, which credits investors for base metal (copper, nickel and zinc etc.) mining and exploration conducted in the province of Ontario.

The tax benefits to investors with taxable income at the highest marginal rate in Ontario (this is income over $127,000) can be substantial. Furthermore, for Ontario residents only, there is an additional tax benefit by investing in a “Super Flow-Through”, which credits investors for base metal (copper, nickel and zinc etc.) mining and exploration conducted in the province of Ontario.

Using an example of a Super Flow-Through that we are comfortable in recommending to clients, the results in 2010 would have been as follows. Using an Ontarian investor, with taxable income of $200,000, assuming in 2010, they made a $10,000 investment in Super Flow-Through shares, the tax savings would have been $5,677.72.

Typically, Flow-Throughs remain invested for a period of 18 to 24 months before they are collapsed and the funds distributed back to investors. When the funds are repaid to investors, the amount of the investment repatriated is taken in the form of a capital gain, so typically, if 60-70% of your capital is returned when the Flow-Through winds down you will have broken even, anything above his is profit. Depending on the Flow-Through issuer, there can be an opportunity to roll the proceeds over to a corporate class mutual fund, which would continue the tax deferral of the capital gains.

Who is the ideal candidate to purchase a Flow-Through? In general, the ideal candidate is someone earning income at a high tax rate with the ability to take on the increased risk of junior mining and exploration companies. The obvious reason, which is discussed at length above, is to maximize the tax savings. Also, for someone with capital losses from the past, a Flow-Through is a very attractive strategy to make use of the losses as any gains would be negated.

Though Flow-Throughs do carry increased risk, we firmly believe that right now is an excellent time to invest. Over the last several months, on the backs of a number of global macroeconomic issues, resource prices have come down significantly. This presents a strong opportunity for investors to participate in the growth in commodity prices through junior mining and exploration companies with diminished risk in light of the recent sell-off. When combined with the buffer created through the tax savings, the investment opportunity becomes very attractive.

To find out more about opportunities using Flow-Through shares, contact our specialist on this matter, Mark Sherboneau BBA, CIM®.

Comments

Post new comment