Out with the Dog in with the Pig

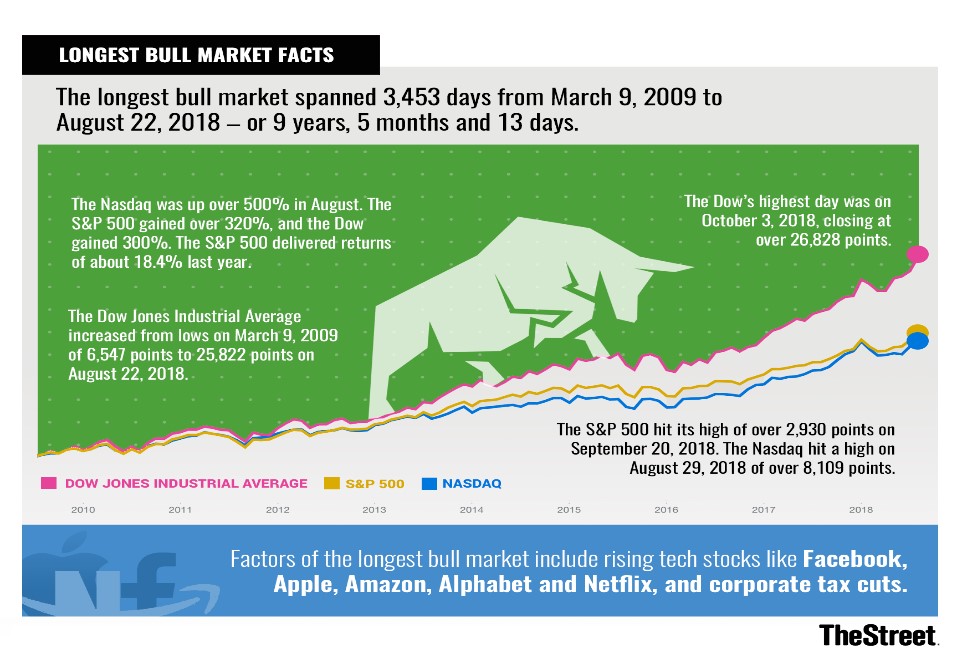

Submitted by Foundation Private Wealth Management on February 13th, 2019Over the last decade, we have been experiencing one of the longest bull runs in market history. Coming off the heels of the Great Recession of 2008, many are calling this the most unloved bull market in history, as investors have been hesitant to go “all-in” on equity markets, expecting the shoe to drop and 2008 to happen all over again. For some, the fear started to become a reality at the end of last year…

By now it is no surprise to anyone that 2018 did not turn out to be a great year for investors, virtually across the board. This Christmas, Santa seemed more of a Grinch than a jolly old fellow, with markets sliding heavily through Christmas Eve. Overall this was the worst December since the Great Depression, leaving the S&P 500 down 6.2%, the worst year since the 2008. At the outset of the year, many (including us) would not have thought 2018 would have turned out as it did as corporate earnings remained strong, balance sheets solid, and overall economic growth decent. So, what happened and why did the market slide?

In hindsight, despite the favorable investment climate, several headwinds have been moving to the forefront to create an unwelcome, but necessary, correction to the later stage of this bull run. The largest influence on the market last year was the change in tone and direction by many of the major central banks around the world, including North America where the Bank of Canada and US Federal Reserve began the upward hike on short-term rates. At home, this put increased pressure on the record debt loads Canadian families, among other pressures. Down south, the US flirted with an inverse yield curve in December, which historically has been a leading indicator of recessions and caused some late-year selloffs by jittery investors. This was all mixed in with geopolitical pressures, largely centered around our good friend and infamous Tweeter to the south. Additionally, tension sprung back up overseas due to the Brexit drama and in Italy, as they were pushed by the European Union to adapt a more conservative budget.

With this back drop central bankers opted to ease off on their tightening polices, bringing some sanity back into the markets so that participants can focus more heavily on corporate earnings. As reports have been coming out from companies in 2019, earnings are exceeding expectation and forward guidance is looking healthy. This could be a good sign of things to come, ushered in by the Year of the Pig, which in Chinese mythology is believed to represent luck, fortune, and wealth!