A Matter of Confidence

Submitted by Foundation Private Wealth Management on August 8th, 2011After experiencing the largest single day correction since early 2009 last Thursday, markets have continued to fall in the wake of the downgrade of the US credit rating by Standard and Poor’s (S&P) and rising concerns over slower growth in the global economy.

Last week, markets were pushed to the brink as political infighting put the US in a very tenuous situation as questions arose regarding their ability to pay off debts. Even after a bill to raise the debt ceiling and cut spending was signed into law by President Obama on Tuesday, an apparent lose-lose situation emerged as the markets became concerned over potentially slower economic growth as a result of the austerity measures. To summarize, the consequences of averting one potential crisis lead to increased pessimism towards the economy in general.

Even as the fundamentals on the microeconomic level remain strong and we saw very positive jobs numbers out of the US on Friday (the markets were expecting worse than expected numbers), the markets once again fell sharply as the day progressed. In light of this, please see the comments below from Dan Janis, Senior Vice President and Senior Portfolio Manager for the Manulife Strategic Income Fund, a manager we use for his expertise on the global markets, specifically fixed income.

"This isn't an economic crisis, nor a debt crisis. This is a crisis of confidence. Investors are betting on a double dip recession, however we feel this is an unlikely scenario. More likely this is a period of summer weakness where markets are prone to irrational trading activity. We put the probability of a doubledip recession at less than 20 per cent. This is simply a soft-patch in the economy that comes at a time of weaker investor sentiment.

"Unfortunately, the actions of U.S. politicians over the past few weeks, coupled with the ongoing European debt issues have eroded investor confidence. Now is the time when we need clarity and direction from the ECB (European Central Bank) and the Federal Reserve. In the past couple of days we have seen the Swiss and Japanese central banks step in to weaken their respective currencies - it remains to be seen how successful they will be.

"What was interesting with the sell-off is that high yield bonds did not fall by as much as might otherwise be expected. Which benefited our portfolio. Our viewpoint and strategy has not changed. We continue to believe investors need to embrace credit and currency risk. That is, the health of corporations has rarely been better and the emerging market economies continue to perform well. Putting the 'noise' of the past few months aside, fundamentals remain intact."

As Dan notes, the recent fall in the markets is not based on a crisis or fundamentals. It is simply a matter of confidence. This is further proven with the S&P downgrade of the US’ Credit Rating from AAA to AA+. Typically, this change would cause investors to sell the treasuries out of fear but, even with the downgrade, US Treasury yields are decreasing today as investors flock to safety. Governments and investors alike are affirming that the US Treasuries are still the safest investment in the world.

Though opinions have varied on what the final impact will be as a result of the US credit downgrade, we wanted to share some comments from Warren Buffett, which confirms his belief in the US economy:

This is a difficult time to be an investor as no one is sure when the markets will rally. We can say, with confidence, that this is also a time where our hand-picked managers are wisely selecting the best companies possible at discounted prices where the prospects for future growth are very high. Ultimately, we still feel that this market volatility is a short term trend and, as confidence is restored, we will see the markets respond positively. This could happen very quickly or it could take some time, but we firmly believe that it will happen.

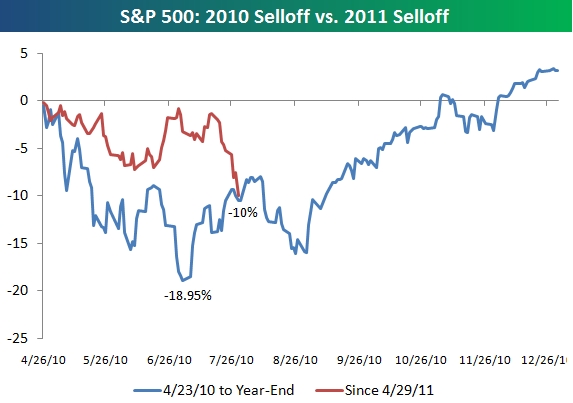

If you recall, in a recent blog titled “Spring Fever” we drew a parallel with what is happening in 2011 with the events that transpired in 2010. From the chart below you can see that, even though the current market correction is sharp, it compares closely to the downturn we experienced just last year as the sovereign debt concerns shook the markets. As you can see, the year finished strong and the downturn was just a small setback to a year of solid performance.

During this period of market turbulence we will endeavour to keep you informed as to what our thoughts are on the markets and, where relevant, the thoughts from some of the money managers we are using in portfolios. If you have any concerns over your portfolio, please do not hesitate to contact us by phone or email anytime.