The Great Tohoku Earthquake

Submitted by Foundation Private Wealth Management on March 18th, 2011As you know on Friday, March 11, Japan was devastated by the largest earthquake in its history, which in turn triggered a massive tsunami that all but wiped out coastal regions of Northeast Japan. Although we cannot add to the abundance of coverage streaming live on most news outlets, what we can provide is a likely outcome of the impending financial and economic concerns.

Mark Twain once said “History does not repeat itself, but it does rhyme.”

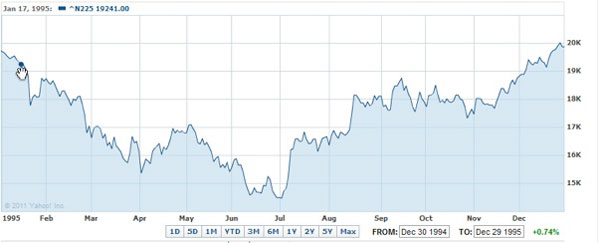

This is very relevant to the current crisis in Japan, as it is a country that has been prone to several natural disasters, especially earthquakes, based on its geographic positioning. A look back at the Kobe earthquake of January 17th, 1995 can provide for a reasonable example of what to expect moving forward.

When the Kobe quake hit in January 1995 the Nikkei Index, Japan’s most commonly quoted index from the Tokyo Stock Exchange, held up reasonably well initially. It then plummeted 8% a week later and ultimately bottomed out in June of 1995, losing 25% of the value of the index prior to the quake occurring. The chart below highlights the drop in the Nikkei Index along with recovery that occurred later in the year.

Source: Yahoo Charts

The chart below is the Nikkei Index year-to-date (as of market close on March 16, 2011). If we consider what has happened in the short period since the quake last week, we can see that the initial response has been swifter as compared to the week-long delay after the Kobe quake hit. This is to be expected given the speed at which information travels today as opposed to the mid-nineties.

Source Yahoo Charts

Around the world, if we use the S&P 500 index as a benchmark to compare global markets from 1995 to today, you can see from the chart below that we saw virtually no reaction to the Kobe quake.

When looking at the year-to-date chart of the S&P 500, again we see a very negligible response to the Tohoku quake with only a modest decline.

Source: Yahoo Charts

In general terms, the prolonged economic impacts of catastrophic events such as these tend to be localized within the market affected and the response is typically short in duration, resulting from the initial reaction to the crisis. We believe that this will be the case again.

Media outlets have opined that this quake will have longer term effects on the global economy based the size and magnitude along with tsunami that followed, all of which will cause large disruptions in global trade. We do think that there will be potential supply disruptions in global trade, but again this event is only a rhyme of the past and not a replication. Looking back to 1995, the Japanese economy represented 17.9% of global GDP whereas in 2009 Japan’s economy only represented 8.7% of global GDP. Based on Japan’s lack of prominence in the global economy, we do not believe that the global economy will be driven back to recession as a result of any short terms effects from the recent quake.

As we feel that any negative market reaction will be primarily localized to Japan, the next question is how much of an impact does Japan have on our portfolios? In terms of our typical portfolios, we have Japanese exposure primarily through two of our global equity holdings, the Dynamic Global Value Fund and the Manulife Global Opportunities Fund. The exposure to Japan in both of these positions is less than 3% of the total holdings. This is largely because the money managers we have chosen have similar beliefs to us regarding Japan, that essentially Japan is currently stuck in a long term secular bear market that began in the early 1990’s and does not exhibit attractive fundamentals or valuations. Ultimately, the impact of a downturn in the Japanese market would be very minimal in our portfolios.

In conclusion, we do not believe that this tragic event will have a significant or prolonged impact on global economy or consequently our portfolios. The greatest impact, which will be felt for some time to come, is on the Japanese people. Our thoughts are certainly with them in this time of great adversity and we hope for a quick end to this crisis.

Comments

Post new comment