Everything You Wanted to Know About Investment Fees But Were too Afraid to Ask – Part 1, The MER

Submitted by Foundation Private Wealth Management on April 12th, 2011Investment fees that are paid by retail investors, in particular through mutual funds, continue to be misunderstood despite the numerous attempts from various regulators and self regulatory agencies in Canada to come up with better methods for disclosure of fees. I believe the reason for this issue is two-fold. Firstly, many investors feel uncomfortable asking their advisor about the fees they pay for managing their investments. Furthermore, when clients do ask their advisor about fees, many advisors provide the response “I am paid through the MER of the fund”, which is very ambiguous and usually leads to a follow up question:

So, what is an MER?

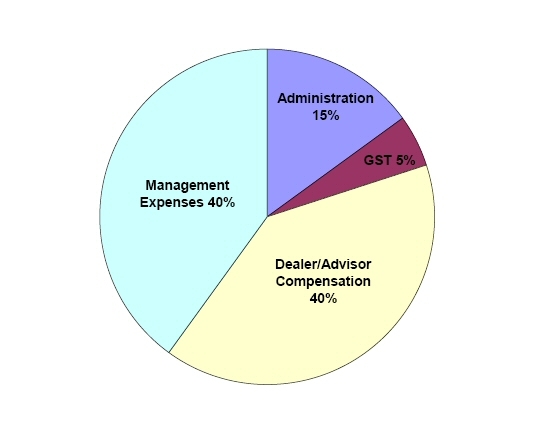

The Management Expense Ratio (MER) is the embedded fee a mutual fund company charges to operate their fund. The MER includes the management expenses, administration, taxes and dealer/advisor compensation. Below is a chart provided by the Investment Funds Institute of Canada (IFIC) that provides a general breakout of the components of the MER.

The management expenses are the costs the Fund Company has for managing the fund. This includes research costs, portfolio management, marketing and the profit of the Fund Company.

Administration includes costs such as legal fees, client services costs, transaction processing, statements and document management and other such administrative costs.

Of course the 5% GST portion, which has now been replaced with the 13% HST, is the taxes that are paid by the fund on the above-mentioned fees.

Lastly, the ‘Dealer/Advisor Compensation’ is the portion of the MER that is paid to the advisor. There are two parts to this equation, the dealer portion and the advisor portion. Currently, Foundation Private Wealth Management uses FundEX Investments Inc. (FundEX) as our dealer. Under the FundEX model, we pay approximately $22,000/year per advisor to FundEX for our licensing, back-office support and compliance oversight. In return, we receive 100% of the commission from the funds we sell. This model is not typical in the Canadian investment industry as most dealers operate a system that levies a percentage charge of commissions based on the total amount of commissions generated by the advisor and the assets under management he or she has in their client base. We feel that the “flat fee model” that FundEX uses reduces the potential conflicts of interest between the advisor and client as we are not incented to generate more commission in order to receive a greater percentage of the total dealer/advisor commission, which is the case with most brokerages and bank-owned firms.

Assuming this answers the question on what an MER is, it still doesn’t answer the real question, which I will cover off next week... How does an advisor actually get paid?

Comments

Post new comment