The End of an Era

Submitted by Foundation Private Wealth Management on January 12th, 2016

Submitted by FPWM Securities

Now that we have crossed over into 2016, it is important to look back at what happened in 2015 to gain a perspective of what might continue in 2016. The year ahead will be especially important for Canadian investors as Canada will be in the cross hairs of the events that have begun to unfold.

2015 was shaped by two major events - the end of the commodity super cycle and the end of loose monetary policy in the United States. The commodity super cycle that, arguably, began in and around 2002 had a massive effect on global economies, in particular Canada. It could be argued that this cycle ended earlier than last year; however, the sharp decline in oil prices served as a final confirmation. This super cycle was driven by growth in the emerging economies, led by China. Consequently, it’s been the slowing growth here that has been the largest factor leading to the end of the cycle. As demand for commodities has dropped due to slower global growth, the negative effects are being felt throughout economies that rely heavily on commodity production. This was the main reason why the TSX was down almost 12% in 2015.

The second major event, the end of loose monetary policy in the United States, was marked by the first increase in interest rates since 2006. The easing of monetary policy had been occurring in the US, as they had been reducing the amount of Quantitative Easing (this is a process, essentially, where a central bank creates currency to buy existing bonds with goal of stimulating the economy), but the first increase in rates truly signaled the end of loose monetary policy, for now. It also signaled that the US Federal Reserve felt confident that the economy was strong enough to tolerate higher borrowing costs, so we expect more to come through 2016.

The end of both of these periods had a major impact on currency, of course, as the Canadian dollar relative to the US dollar closed the year at $0.7209 or just over 16.25% lower. It wasn’t just the strength in the US dollar that led to this currency division between us. Diving oil prices also caused the Canadian dollar to decline in two ways. Firstly, with oil prices lower, foreign buyers need less Canadian dollars to buy oil or other commodities. Also, since commodities make up a significant portion of the economy, the Bank of Canada cut interest rates in an attempt to stimulate the Canadian economy and hopefully reduce the cost of our manufactured goods to foreign buyers, thereby stimulating the manufacturing base in Canada. Thus, with Canada cutting rates and the US increasing at the same time, the gap in relative values of our respective currencies widens.

In the opening days of 2016, we are already continuing to see these events determine the market direction. With the backdrop of this past year, what can we expect in 2016?

For the US markets, where we have our heaviest client allocation from a stock perspective, we are likely to see average growth. The reason I say this is that US stocks, which were quite undervalued several years ago, have now reached the territory where they are at or near full valuation (broadly speaking). This means that going forward we can reasonably expect 1.25% -1.5% or so from dividends, 2-2.5% from GDP growth and around 2% for multiple expansion. When you add these up, we could be looking at growth in US equities at or around 5.5% range, including dividends, for the year. As Canadian investors, we will gain some upside on these numbers if the deterioration of the Canadian Dollar continues as expected, the factors of 2015 continue to affect this exchange rate. This could add another 9-10% to returns on US equities if the Canadian Dollar ended the year around $0.65 US.

For Asian markets there are really three distinct buckets to identify, which are Japan, China, and the rest of Asia. With respect to Japan, they have been treading down the same path as the US has just come from, in that they are vigorously attempting to re-inflate their economy through a massive quantitative easing program. It seems, at this point, that the program has started to work and definitely with more YEN chasing the same amount of assets, Japanese stocks should be a winner.

China, as we have already seen in the opening days of 2016, is the big issue that will have the largest impact on global markets. The transition from an export driven to an internally driven, consumer economy, which we have written about in the past, is causing major disruption to their domestic economy as well as impacting stock markets around the world. It remains to be seen how a centrally-controlled economy will be able to manage this transition as governments are notoriously poor allocators of capital. The one safeguard that exists for China is that they are far more nimble to react to a major crisis, given that they have complete control and do not need to seek the approval of their population. Plus, they are sitting on top of a hoard of currency reserves, which means money is really no object for them.

For other Asia, of which I will group in the emerging markets, there are too many risks, in my opinion, to consider these economies as a strong place to invest in 2016. We could draw up a number of scenarios, starting with the more current risk of currency devaluation in response to China's devaluation of their currency, that all lead to a number of unknowns in terms of how the markets will react. All that being said, it will likely be a risk that is not mentioned, or was not thought of, that could have the greatest impact on these markets, either in a positive or negative way. So, for the time being, we favour the developed markets over the emerging markets.

Looking at home, I feel that we could very well be at the start of an economic decline in Canada. Initially the declines in the Canadian markets were triggered by the significant drop in demand for resources. Moving forward, it is our belief that that the tide is leaving the bay and we will soon start to see, on a wider scale, who was swimming naked as Warren Buffett might put it. I would expect that as the price of oil and other commodities remains low this will begin to permeate in to the broader Canadian economy, potentially affecting the severely over-levered Canadian consumer. If this does happen it could potentially impact the Canadian economy on a similar scale as what we saw in the US in 2008; however, the effects would be milder based on our lending practices. Overall, I do not see a major travesty forthcoming in Canada, but we would prefer to maintain a low weighting to Canadian Equity, which has been in place for the last several years. I also expect that we will see a rate cut from the Bank of Canada, as Governor Poloz tries to mitigate the damage and stimulate export driven growth through a lower Canadian dollar, something that has seemingly not worked yet.

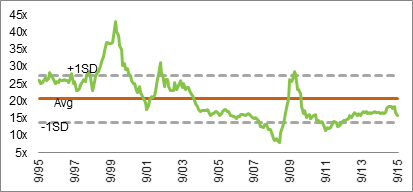

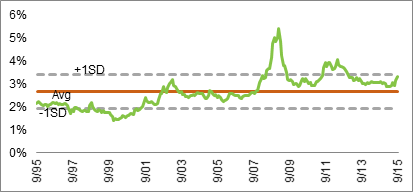

The area that is most likely to shine in 2016 is the European markets. Currently, they are still quite cheap as measured by price to book, price to earnings, and price to cash flow as seen in the charts below. A low price, in combination with a healthy dividend yield, is always a good start to a sale; but, what is a good sale if it isn’t advertised? The good news is we’re starting to see some ads out there, so to speak. By this I mean that two factors are now coming together to awaken the European markets which should lead to the valuations on their stocks being realized in the near future, generating solid returns. The first factor is the onset of Quantitative Easing in the Europe, which should stimulate the economy. The second factor is the decline in energy prices. Most European countries are net importers of energy, meaning they bring in more than they produce, and the fact that energy prices are so low will only add fuel to the fire (pun intended). With that, I think it is reasonable to expect that stock prices appreciate in Europe, inching closer to fair market value through 2016.

Fundamentals of MSCI EAFE Index September 30, 1995 – September 30, 2015

Price to Book

Source: MSCI, FactSet. Figures for MSCI EAFE Index. Past performance is not a guarantee of future results.

Price to Earnings

Source: MSCI, FactSet. Figures for MSCI EAFE Index. Past performance is not a guarantee of future results.

Price to Cash Flow

Source: MSCI, FactSet. Figures for MSCI EAFE Index. Past performance is not a guarantee of future results.

Dividend Yield

Source: MSCI, FactSet. Figures for MSCI EAFE Index. Past performance is not a guarantee of future results.

In summary, in 2016 we will look to trim our weighting in US equities, taking profits and redeploying to developed European countries. Our low weighting to Canada the emerging markets will remain unchanged. Volatility will continue to remain as global economies adjust to the end of the two eras and our weighing to USD though equities and fixed income will help to buffer against this volatility. I think that, especially in 2016 with the market gyrations on an elevated level shortly after the clock striking midnight, we should remember that a few days at the start of year are not a relevant indicator for future performance over the reminder of the year.

Disclaimer:

The information contained herein was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any securities. The views expressed are those of the author and not necessarily those of ACPI.

Comments

Post new comment